- What They Said

- What It Means for Our Economy

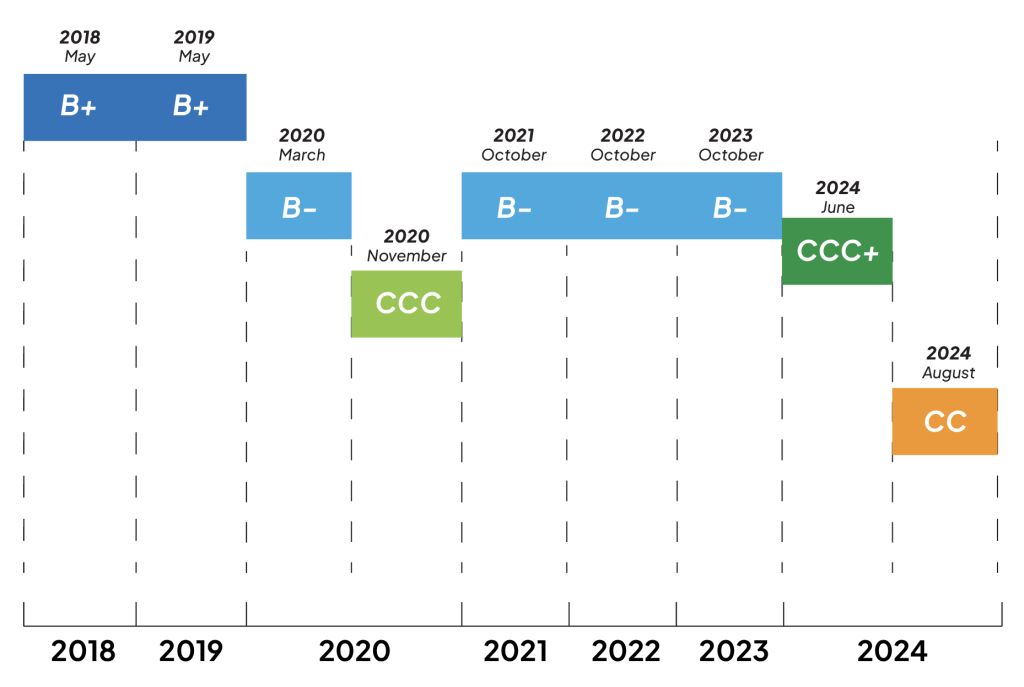

- Maldives Fitch Ratings Over the Years

Fitch has downgraded the Maldives’ rating to ‘CC’ from ‘CCC+’ :

1. Increased risk of default:

- indicates a higher risk that the country may default on its debt obligations.

2. Declining foreign exchange reserves: The country’s foreign currency reserves have fallen significantly, reaching their lowest level since December 2016. This makes it harder for the Maldives:

- to pay for imports and

- service its external debt

3. Rising external debt: The Maldives has large upcoming debt payments, with external debt servicing expected to exceed $1 billion in 2026.

4. Economic pressures: The country is facing persistent US dollar shortages, high current account deficits, and tightening liquidity in the banking system.

5. Challenges in obtaining support: The high and rising public debt makes it more difficult for the Maldives to secure financial assistance from international partners or organizations like the IMF.

6. Uncertain financing plans: There’s increasing uncertainty about the government’s ability to refinance its debt and accumulate enough foreign currency revenue to meet its obligations.

What It Means for Our Economy

1. US dollar shortages:

- Hinders import financing.

- Impedes ability to meet international payment obligations.

- Threatens currency peg stability.

2. High current account deficits:

- Significant import-export imbalance.

- Indicates economic vulnerability.

- May increase external borrowing needs.

3. Tightening banking liquidity:

- Reduced liquidity in banking sector.

- Constrains credit extension.

- Impairs financial intermediation.

Cumulative Impact:

The Maldives faces a precarious economic situation following Fitch’s downgrade to ‘CC’. With dwindling foreign exchange reserves and rising external debt, the country risks defaulting on its obligations. Persistent US dollar shortages and high current account deficits strain the economy, while tightening banking liquidity hampers business growth. The government’s ability to secure international support or refinance debt is increasingly uncertain. This confluence of factors is a serious threat to the Maldives’ economic stability.

| MAY, 2018: | ‘B+’; Outlook Stable |

| MAY, 2019: | ‘B+’; Outlook Stable |

| MAR, 2020: | Downgrades to ‘B’; Outlook Revised to Negative |

| NOV, 2020: | Downgrades to ‘CCC’ |

| OCT, 2021: | Upgrades to ‘B-‘; Outlook Stable |

| OCT, 2022: | Revises Outlook to Negative; Affirms at ‘B-‘ |

| OCT, 2023: | ‘B-‘; Outlook Negative |

| JUN, 2024: | Downgrades Maldives’ Long-Term IDR to ‘CCC+’ |

| AUG, 2024: | Downgrades Maldives to ‘CC’ |