‘…keep your eye on one thing and one thing only, how much government is spending. Because that’s the true test… You are paying for it. If you are not paying for it in the form of explicit taxes, you are paying for it indirectly in the form of Inflation or in the form of borrowing’ Milton Friedman

While I hurry to add that I am not, by any means, a Friedman conformist, my task here is almost made unnecessary by his quote above.

In a very practical sense, we always pay for the excesses of the state, any state. We, the citizens pay for the ill-disciplined extravagances of the government either through explicit taxes, or due to the result of inflation and finally by contributing to repay national debt, in fact with interest.

Allow me to try unravel the Friedman quote, in the context of the Maldivian economy.

Paying through taxes

Citizens here, like most everywhere, pay a variety of taxes directly and indirectly. There’s ‘GST’ on goods and services, and a myriad of fees on our vessels and vehicles and Income Tax over a threshold.

For businesses, there’s ‘import duty’, levied on certain items, at the gate of the Customs department and of course ‘business profit tax’. All of which, of course, work themselves back into the cost of goods and services sold, and is ultimately paid by unsuspecting Joe Public.

When we venture into the rarefied realm of the tourism industry, we need to account for ‘land rent’, ‘bed tax’, ‘green tax’ and ‘tgst’; – gst levied in dollars and at a higher rate. All of which again are unsurprisingly paid for by the visiting tourist.

Not being ‘Maldivian taxes and levies 101’, we need not delve deeper, and these are relatively easier to grasp at a conceptual level.

Paying through Inflation

Inflation is the increase in prices over a period of time. It being common knowledge that generally prices always move upwards through time, it’s when prices move over and above productivity growth, that inflation becomes of concern.

Out here in the Maldives, we face the impact of inflation for 2 very different reasons:

cost-pushed inflation imported into the country and the de-valuation of national currency arising out of extra money being pumped into the local economy. Let me try to unpack both.

Imported Inflation

We are, as is commonly known, a country that imports 95% of the goods that we use for daily consumption and capital purposes. While the reason and the wisdom of some of the imports may need to be queried, it’s a question for another day. We will limit ourselves to state the obvious that even our main export product of canned tuna are also being imported and sold at prices below local production, and leave it at that.

Therefore, inflation that spread through the world, is continuously imported into the country. As we maintain an average current account deficit of minus $1.2b (Table 1) imported inflation work themselves into the cost structure of consumer and capital goods and investments too. Post Covid hikes in international logistic costs, impact from the Russian invasion of Ukraine, and lately arising from the Middle East fiasco, walk themselves into our economy with no impedance.

Table 1. Current Account Deficit (2018-2023)

| Year | Current AccountDeficit (millions US$) |

| 2018 | -1,502.5 |

| 2019 | -1,478.3 |

| 2020 | -1,327.2 |

| 2021 | -453.4 |

| 2022 | -1,003.7 |

| 2023 | -1,400.9 |

While the concept of Imported inflation is quite straight forward, out here in the Maldives, a substantial portion of the impact of imported inflation is camouflaged through national subsidy programs to the tune of an average of over MVR 9b (Table 2). Record prices of oil and grain, arising from turmoil in Ukraine and in the middle east, are veiled to the public by blanket state subsidies.

Table: 2 Proposed and Actual Subsidy (2022 -2024)

| Year | Actual (MVR b) | Proposed |

| 2022 | 8.4 | 4.8 |

| 2023 | 9.7 | 6.6 |

| 2024 | ? | 9.4 |

Home-Cooked Inflation

‘Home-cooked inflation, for want of a more apt term, arises because of the policies of the state. They are more difficult to tease out, therefore more difficult to identify who it will hit and how.

This ‘home-cooked’ inflation is mainly the result of the state pumping more money into the economy than is warranted by productivity gains. Our cultural trait of wallowing in large budget deficits continuously feeds the inflation sluggard in a variety of ways.

Generations of politicians have built castles in the air, with no fiscal struts to anchor them. We are witness to awarded salary hikes not tied to any output measures, and a litany of capital projects with no corresponding productivity gains. Successive governments have even shied away from imposing a toll tax on the Hulhumale’ bridge, even while the bridge was designed for and meant to collect a toll for maintenance and up stay.

Additionally, towards every election, we witness the discounting, postponement and even full pardon of a variety of income measures including the rent of our biggest public housing scheme; – ‘hiyaa flats’, outstanding fines from a variety of encroachments and even dues to the tax authority.

Stating that many of the fiscal excesses of the state are in clear contravention of not only the spirit but of particular articles of the of the Fiscal Responsibility Act 7/2013, really pales into nothing as our politicians have in fact been contravening standard laws of physics, for decades.

[Aside]Although first theorized in 2008 as an extension of quantum dynamics, experiments in 2024 have now succeeded in creating energy from the vacuum. But only for a very, very short period of time, and only across microscopic distances. While the scientific world marveled at the extraction of energy out of thin air, albeit for very brief moments in the time-space continuum, our politicians have been creating money from nothing for decades. Not only have we created money out of nothing, but we have also mastered the art and science of converting that into national debt exceeding 140% of GDP at times.

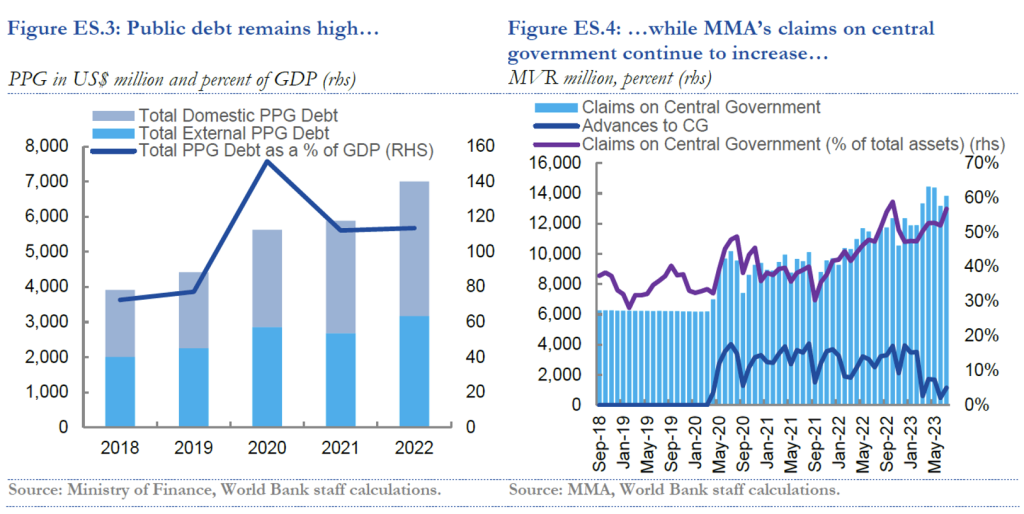

Fig 1:

Over the last couple of years, while IMF and the World Bank with new-found zeal, had been warning us about gathering storm clouds, our politicians have worked with a vengeance to prove that ‘them guys don’t know nothing.’

Fig 2: Collection of Front covers of World Bank Reports on Maldives

While we have rarely been noted for fiscal caution, over the past 2 years we have been spending money akin to the proverbial sailor on shore leave. We had successfully exceeded budget figures on expenditure by 1.2 billion even while income was 7.2 billion over budget in 2022. The government then, really disciplined itself by only exceeding deficit targets by 6.6b, while income was 2.3b over budget figures in 2023.

All that extra money, conjured out of thin air, inevitably started a chain reaction resulting in rising prices and the loss of the value of the national currency, also known as inflation.

Additionally, the local currency printed over and beyond what was warranted, chased the lower supply of dollars and inevitably raising the price of dollars. The subsequent imports, purchased at a higher dollar parity, were brought to the market at an even higher dollar conversion rate, because traders were anticipating further deterioration of the national currency.

Bridges and harbors were built, salaries were raised, free education and universal health were offered, and the public were ‘gifted’ with the cancellation of housing leases and fines for infringement of laws and regulations.

As the value of the currency plummeted, the purchasing power of Joe Public evaporated. The most perverse aspect was that, without understanding the real reason for the loss of purchasing power, Joe Public quite easily identified local entrepreneurs as the bogeyman in the story.

Paying for the borrowing of the State

Even before other avenues are even explored, and without rhyme or reason, states, especially in the developing world, have sought huge loans from big-brother states. Even while sceptics have shown that the main reason was to create a dependent relationship, because of the purely incidental effect of ‘sudden growth symptom’ of the bank accounts of politicians, such white elephants have become a common feature of the landscape of developing nations.

In the rare instance that there is a genuine need and even when borrowed at low rates, healthy grace periods and long re-payments, the nation has in effect borrowed from its future. Future generations will be liable to pay back loans imposed on them without their ‘by-your-leave’ and certainly without their consent.

Conclusion

So, the public, including future generations, will in the end, pay for everything. The cost of running the machinery of the state, the gifted services and subsidies, the excesses of politicians including the cleaning up after too many white elephants, all will be paid by the public.

Yes, when the fandango dances end, the masquerade balls cease, the politicians will not stand up to be counted and the public will be asked to pay the piper.