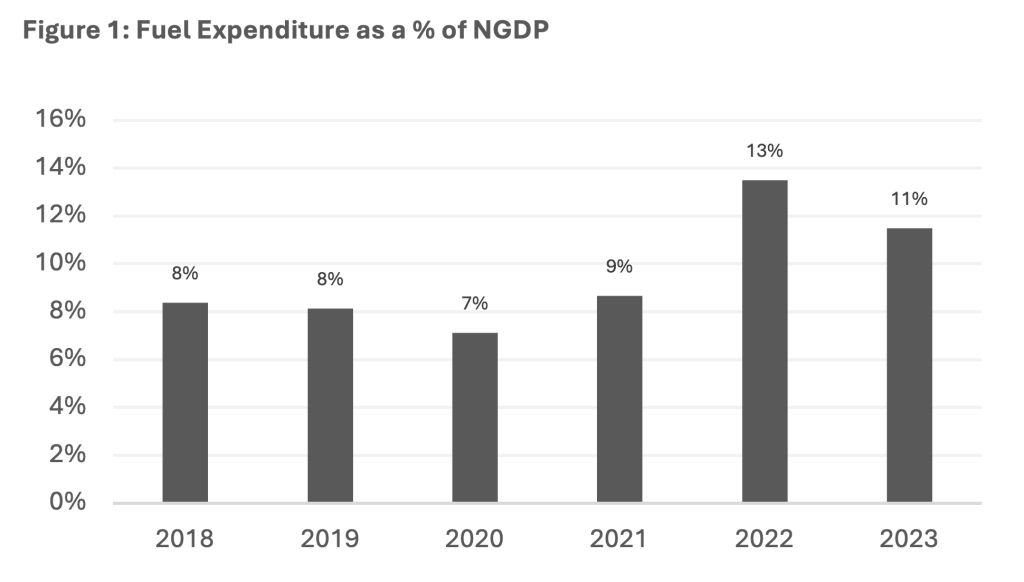

The Maldives faces significant challenges due to its heavy reliance on imported fossil fuels for energy production. In 2023, the country spent around 22% of its total import bill on fuel, with approximately 80% allocated to diesel for electricity generation and marine transport. This expenditure amounted to 11% of the country’s nominal GDP, making the Maldives highly vulnerable to global oil price fluctuations. The heavy dependence on imported fuel increases the subsidy burden and depletes foreign exchange reserves, challenging fiscal stability and economic resilience. While renewable energy offers clear benefits, misaligned incentives within the current energy sector framework hinder progress. This article argues that the Maldives must realign these incentives and promote private sector involvement to accelerate investment in renewable energy, thereby achieving fiscal stability and economic resilience.

Maldives’ Current Energy Challenges

The Maldives’ energy landscape is characterized by a heavy dependence on diesel fuel for electricity generation. The high cost of energy production results from this dependence, with the country importing fuel at elevated prices due to its geographical isolation and dispersion, and small-scale import quantities. Recent statistics show that the Maldives spends more than 10% of its GDP on fuel imports as seen in the Figure 1 below, with half of these imports used for electricity generation. A 2020 ADB report noted that this reliance on diesel leads to high electricity production costs, ranging from $0.19 to $0.70 per kilowatt-hour (kWh), among the highest in South Asia. For smaller islands, these costs can exceed $0.70/kWh due to logistical inefficiencies in shipping fuel in small quantities.

Moreover, the Maldives faces a significant fiscal burden from fuel and electricity subsidies, which are estimated to exceed 1.5% of GDP. As global oil prices rise, these subsidies are expected to increase, putting additional strain on government finance. The Maldives is also vulnerable to external shocks, as seen during the recent global oil price hikes following the Russia-Ukraine conflict. The rising cost of fuel imports has also led to dwindling foreign exchange reserves, necessitating foreign borrowing.

The existing subsidy system, involving entities like the State Trading Organization (STO), the government’s trading arm, Stelco, and Fenaka, both utility providers, is complex and lacks transparency. Fuel is sold to utility companies at a regulated price, resulting in significant discrepancies between the cost of importation and the subsidized rates. In addition, an electricity subsidy is also given to utility providers for the “revenue loss” that these companies suffer due to harmonization (effectively reduction) in tariff rates, thus covering the losses. This complexity further compounds the fiscal strain through misaligned incentives, explained further below, for each of these main actors in the energy sector.

Misaligned Incentives in the Energy Sector

The main incentive of the major actors in the energy sector collectively shall be to produce energy at the lowest possible cost and encourage innovation. The current energy sector framework in the Maldives suffers from several misaligned incentives, leading to suboptimal decisions:

- Subsidized Fuel Costs: which imports fuel, lacks the incentive to reduce the landing cost of fuel since it is subsidized for the difference between the actual landing cost and the regulated price. This discourages cost-effective sourcing or methods of fuel importation, contributing to fiscal strain.

- Regulated Prices and Political Influence: The regulated price of fuel for electricity is heavily influenced by political decisions, preventing prices from reflecting real market conditions. Furthermore, political influence prevents SOEs achieving productive efficiency and Maldivian SOEs depicts heavy overemployment. Political objectives often conflict with the goals of efficiency and productivity that should drive state-owned enterprises (SOEs).

- Distorted Decision-Making: The current subsidy structure distorts decision-making. Each entity—STO, utility companies, and the government—focuses on its own interests, with no incentive to innovate or push for renewable energy adoption. As a result, investment in renewable energy is limited.

- Lack of Incentives for Utility Companies: Utility companies like Stelco and Fenaka do not have the financial motives to invest in renewable energy. Furthermore, the regulatory framework allows rooftop solar PV installations but caps them at 30% of usage to protect these companies. This cap protects the status quo of inefficient providers, rather than incentivizing them to adopt new technologies or improve efficiency.

- Government’s Financial Burden: The government bears the cost increases directly through public finance. Without automatic adjustments to subsidy regimes, cost hikes are absorbed by public finances, leading to growing fiscal strain. Changing subsidy regimes is politically challenging and conflicts with electoral goals, resulting in resistance to change and perpetuation of inefficiencies.

Correcting these misaligned incentives is crucial for encouraging investment in renewable energy and transitioning to a more sustainable energy future.

The Renewable Energy Potential of the Maldives

Despite the challenges, the Maldives is endowed with significant renewable energy resources, as per previously mentioned ADB report, that could reduce its reliance on imported fossil fuels:

- Solar Energy: The Maldives benefits from high solar irradiance levels, making solar energy the most viable renewable resource. Solar photovoltaic (PV) systems can generate approximately 1,200 kWh of electricity per square meter annually. Floating solar installations on lagoons and rooftop installations on government buildings could expand capacity despite limited land space and other challenges.

- Wind Energy: The Maldives has potential for wind energy, particularly in regions like Lh. Naifaru and K. Gulhifalhu. Recent advancements in vertical axis wind turbines suitable for urban areas and the exploration of floating wind turbines could enhance the renewable energy mix.

- Ocean Energy: The country also has potential for ocean energy, including tidal power and currents. Although less advanced, these technologies are considered stable and could provide additional energy security.

- Green Hydrogen and Biomass: Opportunities also exist in green hydrogen production from surplus renewable energy and biomass from local resources like coconut shells, which could serve as long-term alternatives.

Learning from Uruguay’s Rapid Energy Transition

Uruguay provides a powerful example of how rapid energy transformation is achievable even for small economies. Faced with severe fiscal challenges and an energy crisis 15 years ago, Uruguay transformed its energy sector in just five years, reaching 98% renewable electricity by 2017. This success was driven by strategic planning, innovative regulatory frameworks, public-private partnerships, and aligning incentives to position renewable energy as the optimal solution for economic independence and cost stabilization.

Uruguay demonstrated that involving the private sector and creating incentives aligned with market principles could quickly achieve energy goals with less strain on public finances. For the Maldives, adopting a similar comprehensive approach could enable a rapid transition to renewables and overcome current challenges.

A Pathway to Fiscal Stability and Economic Resilience

The transition to renewable energy can greatly improve the Maldives’ fiscal stability and economic resilience:

- Reduction in Government Subsidies: Renewable energy adoption can significantly lower the government’s expenditure on fuel and electricity subsidies, which currently stands at over MVR 1 billion (approximately USD 65 million) annually. These subsidies are necessary to keep electricity prices affordable for consumers but represent a substantial fiscal burden. By increasing the share of renewables in the energy mix, as per the previously mentioned 2020 ADB study, the Maldives could save between USD 340 million to USD 425 million in direct electricity subsidies from 2020 to 2030, depending on the level of transformation achieved. This reduction would free up government resources for other critical areas, thereby easing fiscal pressure.

- Lower Cost of Electricity Production: Renewable energy sources like solar and wind offer a more cost-effective alternative to diesel-based electricity. Currently, electricity generation in the Maldives relies heavily on imported diesel, which incurs high costs due to fuel prices and logistical expenses. By switching to renewables, the Maldives can significantly lower production costs. The reduction in reliance on costly fuel imports will also minimize expenses related to shipping and storage across multiple islands, contributing to overall lower electricity costs and more stable pricing structures.

- Improved Financial Performance of Public Utilities: The shift to renewable energy could enhance the financial performance of public utilities such as STELCO and FENAKA, which currently depend on government subsidies to cover the high costs of diesel-generated electricity. By reducing operational costs through the use of cheaper, locally produced renewable energy, these utilities would become less reliant on subsidies, thereby improving their fiscal sustainability. This change could also encourage a more efficient and innovative energy sector by removing the financial distortions that inhibit investment and competition.

- Reduced Foreign Exchange Outflows and Strengthened Foreign Exchange Reserves: A large portion of the Maldives’ foreign exchange reserves is spent on importing fossil fuels. Transitioning to renewable energy would reduce the need for these imports, thereby decreasing foreign exchange outflows. This reduction would help stabilize the country’s currency and maintain its reserves, which is crucial for a small, open economy susceptible to external shocks. Lowering fuel import costs directly conserves foreign currency, enhancing the Maldives’ ability to buffer against economic volatility. With improved foreign exchange reserves, the country would be better equipped to handle global financial uncertainties, contributing to overall economic stability and resilience.

- Diversification and Stability in Energy Sources: Integrating a mix of renewable energy sources—such as solar, wind, and ocean energy—will diversify the Maldives’ energy portfolio, reducing its exposure to volatile international fuel markets. This diversification enhances the country’s energy security, making it less vulnerable to price fluctuations and potential supply disruptions in global fuel markets.

- Support for Sustainable Economic Growth: Investment in renewable energy can stimulate sustainable economic growth by reducing energy costs and subsidies, which frees up resources that could be redirected to essential sectors like healthcare, education, and infrastructure development. Additionally, renewable energy projects have the potential to create jobs, foster technological innovation, and build a skilled workforce, all of which contribute to greater economic resilience and a more diversified economy.

Recommendations for Overcoming Misaligned Incentives and Encouraging Investment in Renewable Energy

To successfully transition to renewable energy, the Maldives should consider the following strategies:

- Redesign Incentive Structures: Reform the current subsidy regime to align incentives with market efficiency. The Utility Regulatory Authority and the government shall ensure that utility companies are subject to competition and “creative destruction,” which will drive innovation and cost reductions.

- Promote Private Sector Involvement: Encourage private sector investment through mechanisms such as green bonds, international donor support, and public-private partnerships. This will reduce the fiscal burden on the government while accelerating renewable energy adoption.

- Comprehensive Policy and Regulatory Reforms: Simplify and increase transparency in subsidy structures, establish an independent regulatory authority, and create incentives for private sector investment in renewable energy projects. Encourage competition and “creative destruction” to allow new market entrants to drive innovation and reduce costs.

- Enhanced Financial Strategies: Explore diverse financing options such as green bonds, international donor support, and public-private partnerships to fund renewable energy investments. Establishing green finance facilities can also attract foreign investment and reduce the cost of capital for renewable projects.

- Public Awareness and Communication: Build public support for renewable energy by highlighting its economic and environmental benefits and promoting it as the best choice for the nation’s future.

Conclusion

Investing in renewable energy offers a transformative opportunity for the Maldives to achieve fiscal stability and economic resilience. By addressing misaligned incentives, encouraging private sector participation, and leveraging its abundant renewable resources, the Maldives can reduce its dependency on imported fossil fuels, lower subsidies, and support sustainable economic growth. A carefully designed and market-friendly energy transition can ensure a sustainable and prosperous future for the Maldives.

References

Asian Development Bank (ADB). (2020). A Brighter Future for Maldives Powered by Renewables: Road Map for the Energy Sector 2020–2030. Manila, Philippines: ADB. doi:https://dx.doi.org/10.22617/TCS200355-2

Beras, E., & Aroncyzk, A. (2023). How did Uruguay cut carbon emissions? The answer isblowing in the wind. Planet Money. National Public Radio (NPR). Retrieved from https://www.npr.org/2023/10/06/1197954251/uruguay-green-energy-carbon-emissions-climate-change

Ministry of Finance. (2023). The Government Budget 2024. Male’: MoF.